How to Make Business Pivoting Less Risky and More Strategic

Every company hits a wall. Some stall in a saturated market. Others face shifts in customer behavior, technology, or competitive pressure. In these moments, the question is how to change without imploding your current business.

How to make business pivoting less risky and more strategic is a leadership challenge. When handled well, a pivot can align the company with fresh demand and long-term value. When rushed or misread, it can drain resources, dilute focus, and damage credibility.

Pivots are not for the timid. But they don’t have to be reckless either.

This blog explores how leaders in scaling businesses are making smarter, more calculated moves during periods of transition. We’ll look at how to avoid common missteps, make better use of existing assets, and create the conditions for pivots that actually stick.

The Strategic Weight of a Pivot

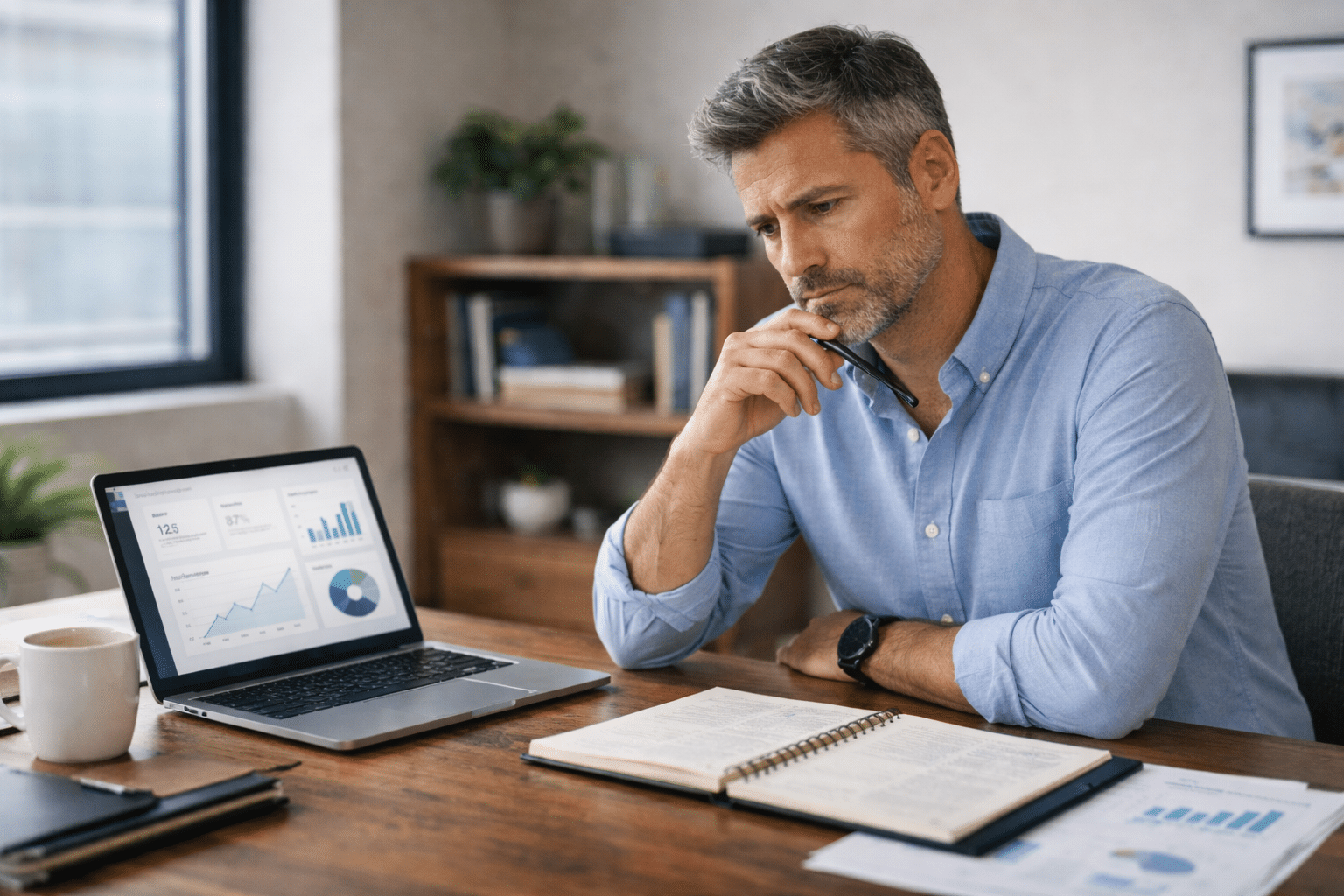

A pivot is about deciding where the future is worth betting—and then putting real capital and leadership attention behind it. Too often, companies pivot out of frustration or fear. Growth slows, a competitor rises, and panic fuels decisions that seem bold on paper but crumble in execution. There’s a reason so many pivots fail: they’re based on assumptions, not evidence.

Netflix, for example, didn’t leap into streaming overnight. They spent years developing the infrastructure, licensing agreements, and user behavior data to support the shift. Meanwhile, DVD rentals—still profitable—provided the cash flow to fuel the transition. That’s how you reduce risk: build your bridge before burning the old road.

Risk Isn’t the Enemy—Blind Spots Are

Every strategic shift carries risk. But not every risk is equal. What trips companies up isn’t the presence of risk, but the absence of awareness.

The smartest companies map their assumptions. They get clear on what they know, what they think, and what they still need to test. Then, they invest in small pilots before scaling anything systemwide.

This Forbes piece reinforces the idea that the riskiest part of a pivot is moving without clarity. The article highlights how top-performing brands use early-stage validation and controlled rollouts to reduce uncertainty. Instead of guessing what the market wants, they test, learn, and adjust in real time—eliminating blind spots before they become costly missteps. It’s a practical look at how smart strategy reduces exposure.

Asset Mapping: The Overlooked Strategic Advantage

How to make business pivoting less risky and more strategic depends on how the company uses the building blocks it already has. It is just a matter of if the business is using them wisely.

Before you move, ask:

-

What are our current strengths?

-

What infrastructure or partnerships can we repurpose?

-

Where are we already winning?

IBM’s move into cloud services didn’t start from scratch. They had consultants, hardware, and global reach. What changed was their market focus and service model. Instead of abandoning the old playbook, they rewrote it with existing resources.

This is how smart pivots work. They don’t discard the past—they evolve it.

Governance: The Hidden Lever for Strategic Pivots

One of the least discussed elements of any pivot is how it’s managed. Who decides what’s working? When do you fund the next phase? How do you course-correct without losing face?

The companies that pivot well don’t leave these questions to chance.

Offers a structured lens to assess when and how leaders should pivot based on complexity and risk

This HBR article offers a structured lens to assess when and how leaders should pivot based on complexity and risk. It underscores the importance of context-driven decision-making—exactly what strong governance enables during a pivot. It introduces the Cynefin framework, which helps leaders assess whether a situation is simple, complicated, complex, or chaotic. In the context of strategic pivots, this thinking supports a governance structure that doesn’t default to rigid plans, but adapts decision rights and cadence based on the level of uncertainty.

Culture Risk Is Strategy Risk

Every pivot comes with internal disruption. You can’t change what you sell—or how you operate—without changing how people work.

That makes communication non-negotiable. So does clarity around expectations, roles, and timing.

When leaders fail to explain why the pivot is happening, employees fill in the blanks. That’s when engagement drops, execution falters, and resistance builds. But when teams understand the stakes—and feel equipped to move forward—strategy turns into momentum.

This is where tools like Align play a key role. Align keeps teams connected to the plan, ensures visibility into evolving priorities, and reinforces accountability at every level—so culture doesn’t fall out of sync with strategy. When everyone knows what matters most, change feels less like chaos and more like progress.

Reframing Failure: Learning at the Edge

Here’s a mindset shift that separates high-performing teams from the rest: in a well-executed pivot, failure is data.

When organizations treat failed experiments as black marks, they discourage the kind of learning that pivots require. On the other hand, when teams are rewarded for generating insight—even from initiatives that didn’t scale—they stay curious, creative, and agile.

Agility is the ability to absorb feedback and adjust course quickly. In this article, Chris Kille offers a fresh perspective on how companies distinguish between productive perseverance and strategic redirection.

Knowing how to make business pivoting less risky and more strategic is about leading through uncertainty —with discipline, with insight, and with a clear view of the ground under your feet.

If you’re considering a pivot, slow down before you speed up. Make sure your data is sharp, your team is aligned, and your process is sound. That’s what gives your move staying power.

Smart moves today lay the foundation for big wins tomorrow.