Maximizing Realized Returns with Software-Enabled, Proactive Portfolio Management

Align has helped thousands of businesses achieve their goals by aligning short-term objectives to long-term vision. Whether hoping to grow their business or prepare for an exit, Align helps businesses map out the path to success and execute it. The tools in Align provide an easy to implement, structured framework for planning strategy and managing goals.

In addition to CEOs, COOs, board members, and people operations managers, business coaches and investors have also utilized Align to map the journey to success for their respective businesses. The easy to interpret planning layout, automated KPI dashboards, and transparent goal tracking provide a proven methodology for operational efficiency and value creation.

In the competitive landscape of Growth Equity and Private Equity, establishing an exit plan, identifying the right KPIs, and executing on growth objectives are key components of portfolio management that maximizes realized returns.

Especially in the transformed COVID economy, Private Equity investors must act quickly to develop customized action plans for their most important portfolio companies. Having a software that enables rapid rollouts of plans and effective execution is no longer a luxury, but a necessity. For firms to stay competitive and on track with investment timelines, proven methodologies will maximize likelihood that returns are realized.

Let’s take a look at three tools that enable effective performance monitoring with the potential to maximize returns

Clearly Define Success with a One Page Plan

Establishing your desired exit strategy up-front helps your firm define success for stakeholders. Any exit strategy must answer a few questions: Who are potential buyers? When should we sell? What factors will drive the valuation?

Based on the answers to these questions, targets for profitability, revenue, employee count, transaction volume, and other metrics fall into place. Further breaking these metrics down into one year and quarterly targets reveals the strategic initiatives needed to achieve targets.

A Virtual One Page Plan in Align.

Align’s highly customizable One Page Strategic Plans create a central location for storing this vital information in an easily accessible way. Clearly lay out exit strategy and the milestones along the way to get your portfolio companies working towards goals. Returns are maximized when the goals of GPs and their portfolio are aligned, keeping everyone focused on the desired outcome.

While firms may have established frameworks for laying out exit strategy and metrics, plans in Align function as a living document and single source of truth with full transparency into the activities that will drive success. By mapping out vision, targets, objectives, and risks/opportunities in one central place, GPs maximize the likelihood of achieving results and returns in a clearly defined time-span.

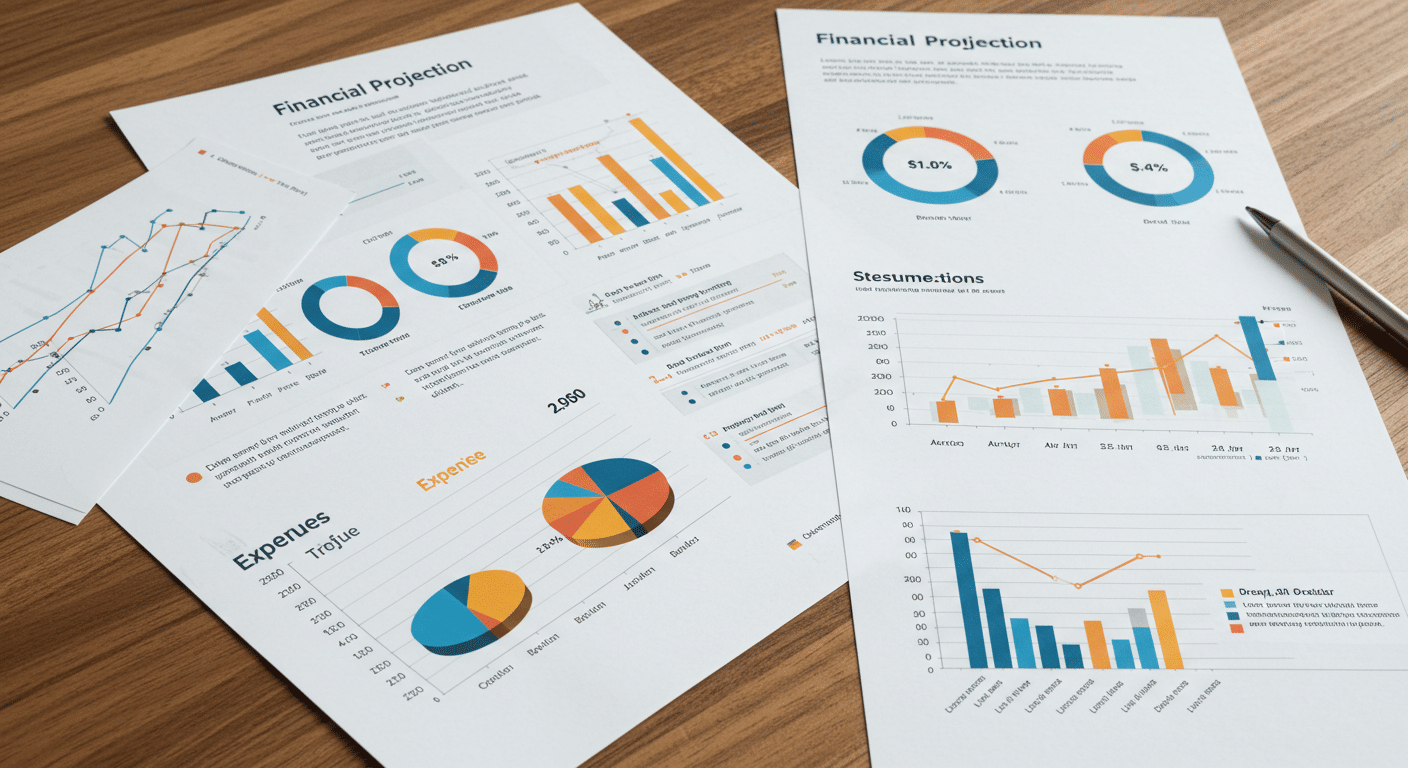

Clearly Track KPIs with Critical Number Dashboard

Private Equity professionals understand the importance of timely and accurate monitoring of Key Performance Indicators. Yet, many still struggle to balance a need for frequent reporting with the time involved in the process. A robust understanding of a portfolio company’s real-time leading indicators is now possible with automated dashboards.

The Critical Number Dashboard in Align integrates with applications like Salesforce and thousands of others with Zapier to give up-to-date measurement of KPIs, performance over time, and progress to goals. As a single source of truth, the Critical Numbers Dashboard provides visibility into performance in an easy to interpret, transparent way. The dashboard also allows annotations of KPI values to facilitate communication between GPs and portfolio company management on results.

Company Critical Number (KPI) Dashboard with Annotations

As leading indicators, Critical Numbers allow GPs to quickly identify underperformance and take steps to intervene. Meetings between deal teams and management become opportunities for resolving issues rather than identifying issues and interpreting data. Instead of waiting for a monthly or quarterly spreadsheet of KPIs to review, the automated dashboard functions as a continuous scorecard. The result is more consistent information sharing and improved returns over time.

Measure Progress to Strategic Objectives with Priority Tracking

Maximizing returns for mid-market Growth Equity and Private Equity firms often entails addressing operational opportunities and risks. Outperforming base case exit scenarios and achieving maximum valuations requires operational efficiency and a focus on identifying and seizing opportunities. A ‘management by objectives’ framework helps to focus efforts on the strategic priorities that increase value.

The Priority tracking tools in Align allow deal teams and management to clearly lay out important strategic objectives and monitor progress. Establishing processes for improving operational efficiency can be complicated and time-consuming for private equity professionals. Having a clearly defined goal framework quickly aligns teams and maximizes the likelihood objectives are achieved.

Strategic Priorities Tracking in Align

Align provides a single source of truth and visual aid for assessing performance on operational goals. By regularly reviewing this progress together, GPs initiate a continuous improvement cycle within portfolio companies. The accountability created by assigning frequently discussed, SMART priorities creates focus and drives execution.

Maximizing Controllable Value

Reducing risk and improving returns go hand in hand for Growth Equity and Private Equity firms. Striking the right balance between empowering portfolio managers and sufficient oversight requires processes that enable continuous monitoring and improvement while aligning stakeholders on what needs to get done.

While the approach of strategic planning, KPI dashboards, and goal tracking requires discipline, the technology that empowers it saves time and facilitates a productive relationship. By spending less time understanding performance, GPs can spend more time identifying strategic and financial opportunities for their portfolio companies. With initiatives clearly tracked, portfolio companies achieve more.

The tools in Align make it easy to execute three components of successful investment management: a clearly defined plan, continuous performance review, and the ability for portfolio company managers to assign priorities and efficiently allocate their time. This technology enables proactive portfolio management, creating value and maximizing returns along the way.

If you are interested in learning more about how technology can create value for your portfolio companies, talk to an Align advisor today.